Edmund Lee, Re/code managing editor, and Brian Blair, Grays Peak Capital, weigh in on Apple’s big launch of the iPhone 6s and share their thoughts

Our goal is to partner with seed to late-stage private and public companies that use technology to catalyze change.

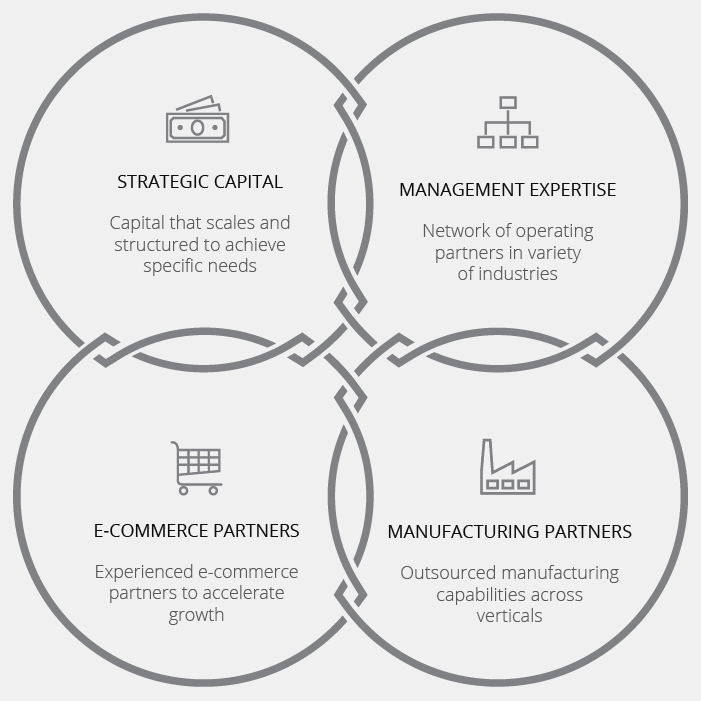

Along with our financial and operational expertise, we help companies to achieve superior brand recognition and increased market share by leveraging our integrated eco-system of operating partners across verticals.

Through our hands-on approach, we help our portfolio companies scale faster and achieve increased profitability with a focus on creating long-term value.

Edmund Lee, Re/code managing editor, and Brian Blair, Grays Peak Capital, weigh in on Apple’s big launch of the iPhone 6s and share their thoughts